Plan zamrożenia oszczędności Rosjan w bankach określany jako nierealny

Andriej Kostin, CEO of one of the largest banks in Russia, VTB, was part of the Russian Prime Minister’s delegation during a visit to Vietnam. During the summit talks – as reported by „The Moscow Times” – he addressed the recurring threat of freezing Russian bank deposits.

The idea of freezing deposits did not come from an anonymous internet forum. Such a possibility was mentioned in November on a radio show by Alexey Zubets, the director of the Institute of Socio-Economic Research at the Financial University in Russia. He explained that Russians have accumulated substantial sums in deposits, taking advantage of record high interest rates. If the Central Bank were to lower these rates, people would rush to withdraw their money, potentially causing a surge in the market. In such a scenario, Zubets suggested that authorities could decide to fully or partially freeze deposits to prevent an influx of cash from triggering runaway inflation and worsening the economic situation.

Andriej Kostin, while explaining the possibility of freezing deposits, stated that it would be a very unpopular and illogical move. In his opinion, there is no reason to implement such measures. However, there seems to be some concern among the population, as the Russian Central Bank also addressed the issue during a meeting on January 13th, deciding to keep interest rates unchanged. So far, Russians have suffered a significant defeat in the fight against inflation. The Russian statistical office reported on Wednesday that inflation had risen by 9.52% over the year, and food prices have not been this high in 15 years.

The bank, in a statement, reassured that the idea of freezing deposits is „nonsense,” and citizens’ savings are already working to benefit the economy, as they are used by banks to finance borrowers. The bank also announced that the next interest rate cut, depending on the economic situation, would take place in 2025 or 2026.

As Russia grapples with rising inflation and economic challenges, it is crucial for authorities to carefully assess the implications of any policy decisions to ensure the stability of the financial system and protect the interests of citizens and the economy as a whole.

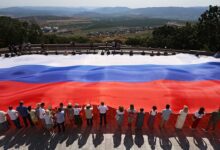

Zdjęcie główne artykułu pochodzi ze strony tvp.info.